Common Cognitive Biases in Investment Decision-Making

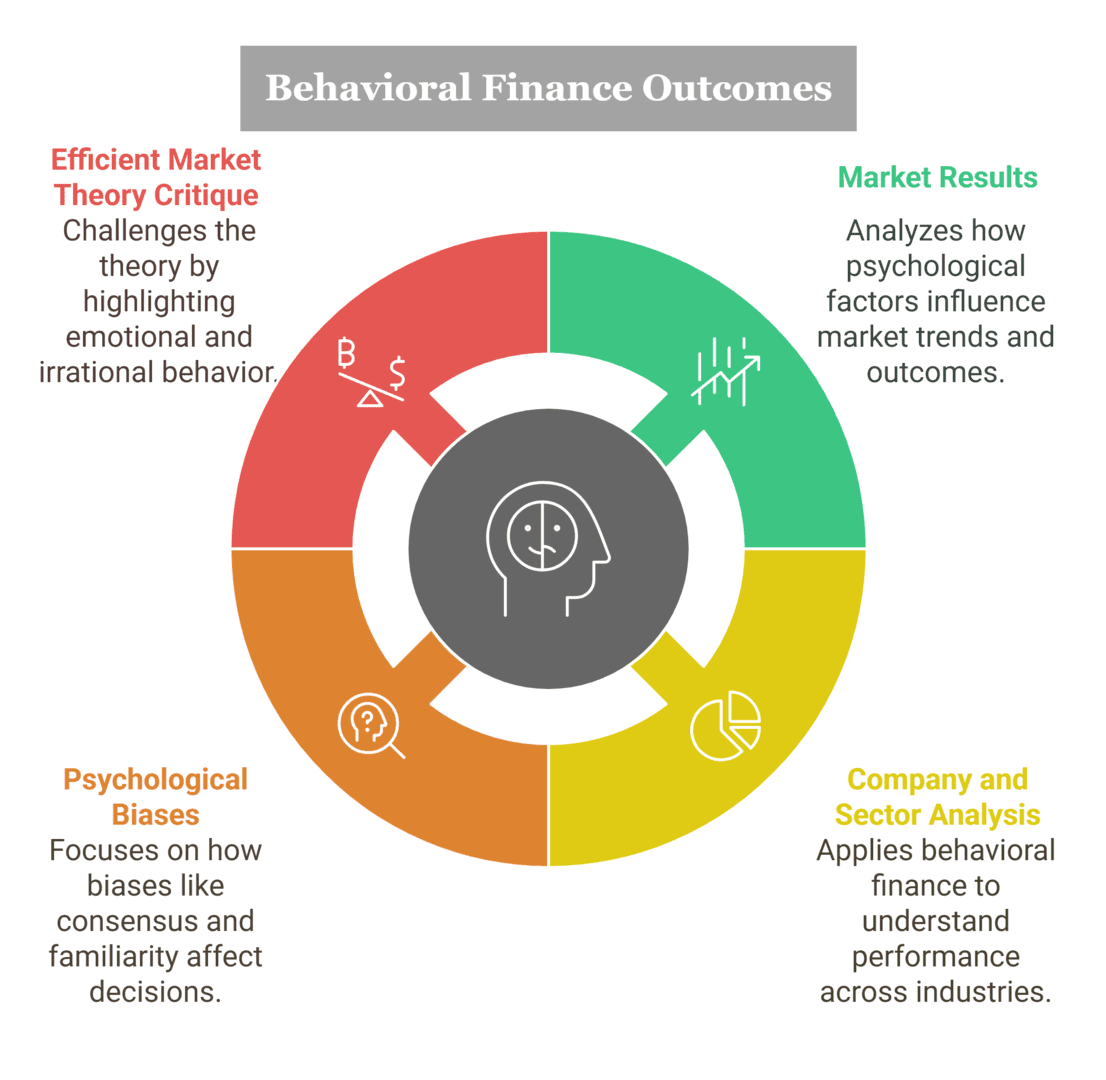

Cognitive biases represent systematic patterns of deviation from rationality in judgment and decision-making. In the context of investing, these biases can significantly impact portfolio performance and risk management. Understanding these psychological tendencies is crucial for developing more effective investment strategies.

Confirmation bias leads investors to seek information that supports their existing beliefs while ignoring contradictory evidence. This can result in overconfidence in particular investments and failure to adequately assess risks. Loss aversion, another fundamental bias, causes people to feel the pain of losses more acutely than the pleasure of equivalent gains, often leading to suboptimal holding periods and risk-taking behavior.

Anchoring bias occurs when investors rely too heavily on the first piece of information encountered, such as a stock's historical high price, which can distort valuation assessments. Mental accounting leads people to treat money differently based on its source or intended use, potentially resulting in inconsistent investment decisions across different accounts or goals.